The current ratio formula (below) can be used to easily measure a company’s liquidity. The current ratio, also known as the working capital ratio, measures the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities. Since the current ratio compares a company’s current assets to its current liabilities, the required inputs can be found on the balance sheet. A significant cash infusion next week, for example, could result in a much higher current ratio at that moment in time than at present.

Current Ratio vs. Other Liquidity Ratios

Even from the point of view of creditors, a high current ratio is not necessarily a safeguard against non-payment of debts. Generally, the assumption is made that the higher the current ratio, the better the creditors’ position due to the higher probability that debts will be paid when due. For example, some receivables included in the current ratio may never be collected, such as if a customer who purchased something from your company on credit goes out of business. As with many other financial metrics, the ideal current ratio will vary depending on the industry, operating model, and business processes of the company in question. Your ability to pay them is called “liquidity,” and liquidity is one of the first things that accountants and investors will look at when assessing the health of your business. Seasonal businesses can experience substantial fluctuations in their current ratio.

What is an IOLTA Account & 5 Mistakes to Avoid

Generally speaking, having a ratio between 1 and 3 is ideal, but certain industries or business models may operate perfectly fine with lower ratios. If a company has to sell of fixed assets to pay for its current liabilities, this usually means the company isn’t making enough from operations to support activities. Sometimes this is the result of poor collections of accounts receivable. The business currently has a current ratio of 2, meaning it can easily settle each dollar on loan or accounts payable twice. You’ll want to consider the current ratio if you’re investing in a company. When a company’s current ratio is relatively low, it’s a sign that the company may not be able to pay off its short-term debt when it comes due, which could hurt its credit ratings or even lead to bankruptcy.

Cash Reserves Ratio

Within the current ratio, the assets and liabilities considered often have a timeframe. For example, liabilities in this ratio are usually due within one year. On the other hand, current assets in this formula are resources the company will use up or liquefy (converted to cash) within one year. The current ratio of 1.0x is right on the cusp of an acceptable value, since if the ratio dips below 1.0x, that jersey city bookkeeping services means the company’s current assets cannot cover its current liabilities. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities.

- In fact, debt can enable the company to grow and generate additional income.

- If you are interested in corporate finance, you may also try our other useful calculators.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- The higher this ratio is, the less likely a nonprofit organization will be able to continue to support its programs in the event that funding goes away.

- The current ratio is one of three commonly used liquidity ratios that company stakeholders, creditors, and investors use to measure short-term financial health.

The current ratio formula

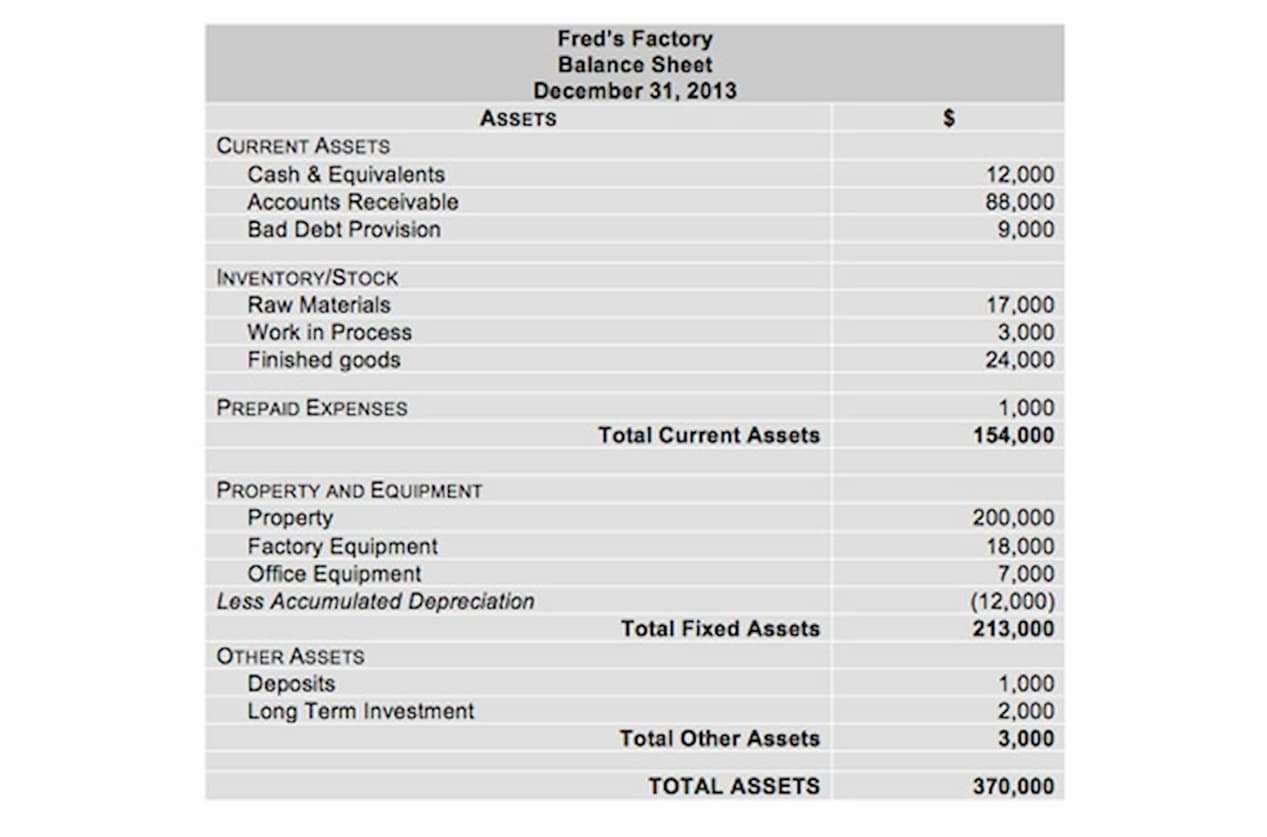

While this is an easier problem to fix than a company that falls below 1-to-1, it’s still not the sign of a well run business. There is no one-size-fits-all rule when it comes to what would be considered a good current ratio. These would either have to be due immediately or within one calendar year. Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1. For the last step, we’ll divide the current assets by the current liabilities.

Balance Sheet Assumptions

The current ratio can be a useful measure of a company’s short-term solvency when it is placed in the context of what has been historically normal for the company and its peer group. It also offers more insight when calculated repeatedly over several periods. For example, if a company’s current assets are $80,000 and its current liabilities are $64,000, its current ratio is 125%.

The Cash Ratio

A current ratio that is lower than the industry average may indicate a higher risk of distress or default. Similarly, if a company has a very high current ratio compared with its peer group, it indicates that management may not be using its assets efficiently. It’s the most conservative measure of liquidity and, therefore, the most reliable, industry-neutral method of calculating it. A lower quick ratio could mean that you’re having liquidity problems, but it could just as easily mean that you’re good at collecting accounts receivable quickly. Ratios lower than 1 usually indicate liquidity issues, while ratios over 3 can signal poor management of working capital. Current assets (also called short-term assets) are cash or any other asset that will be converted to cash within one year.

If the cash ratio is equal to 1, the business has the exact amount of cash and cash equivalents to pay off the debts. If the cash ratio is less than 1, there’s not enough cash on hand to pay off short-term debt. Let’s say a business has $150,000 in current assets and $100,00 in current liabilities. That means the company in question can pay its current liabilities one and a half times with its current assets. First, the quick ratio excludes inventory and prepaid expenses from liquid assets, with the rationale being that inventory and prepaid expenses are not that liquid.

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Besides, you should analyze the stock’s Sortino ratio and verify if it has an acceptable risk/reward profile. If you are interested in corporate finance, you may also try our other useful calculators.

The simple intuition that stands behind the current ratio is that the company’s ability to fulfill its obligations depends on the value of its current assets. One of the biggest fears of a small business owner is running out of cash. To know whether a company is truly on the cusp of hitting a $0 balance in their accounts, you can’t simply look at the income statement. This is because it is generally assumed that you can convert these assets to cash within a year. A higher current ratio is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments. Therefore, applicable to all measures of liquidity, solvency, and default risk, further financial due diligence is necessary to understand the real financial health of our hypothetical company.

This figure can be interpreted through the lens of where a company is in its operating cycle. Another factor that may influence what constitutes a “good” current ratio is who is asking. Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers.

If you are planning a major purchase, try to use a card with a higher limit to keep your utilization rate lower. (And have a plan for paying that major purchase off as soon as possible, as well.) You may also want to spread a purchase over more than one card for that purpose. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. They should, however, be expected to be good stewards of the profit that is generated. In addition, continued negative trends in the net margin ratio can be an indicator of poor financial management.

Property, plant, and equipment is not a current asset because you do not intend to sell them within the next year. These typically have a maturity period of one year or less, are bought and sold on a public stock exchange, and can usually be sold within three months on the market.

A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations. XYZ Inc.’s current ratio is 0.68, which may indicate liquidity problems. On the other hand, a company with a current ratio greater than 1 will likely pay off its current liabilities since it has no short-term liquidity concerns. An excessively high current ratio, above 3, could indicate that the company can pay its existing debts three times. It could also be a sign that the company isn’t effectively managing its funds.

To calculate the ratio, analysts compare a company’s current assets to its current liabilities. More specifically, the current ratio is calculated by taking a company’s cash and marketable securities and then dividing this value by the organization’s liabilities. This approach is considered more conservative than other similar measures like the current ratio https://accounting-services.net/ and the quick ratio. Changes in long-term debt and assets tend to affect the D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets. If investors want to evaluate a company’s short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios.

Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky. If a company cannot meet its financial obligations, then it is in danger of bankruptcy, no matter how rosy its prospects for future growth may be. However, the working capital ratio is not a truly accurate indication of a company’s liquidity position.

This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves. You can also apply for new credit, which will improve your ratio if granted. However, I don’t recommend applying for new credit if you don’t have a need for it.

For example, the inventory listed on a balance sheet shows how much the company initially paid for that inventory. Since companies usually sell inventory for more than it costs to acquire, that can impact the overall ratio. Additionally, a company may have a low back stock of inventory due to an efficient supply chain and loyal customer base. In that case, the current inventory would show a low value, potentially offsetting the ratio. The current ratio, therefore, is called “current” because, in contrast to other liquidity ratios, it incorporates all current assets (both liquid and illiquid) and liabilities.