The costs a small business or nonprofit incurs for bookkeeping will depend upon many variables. At BELAY, our current length of service with our bookkeepers is 25 months – though we have many bookkeepers that have been with us five years and more. Now that you have a better idea of what you’re looking for, here are five questions to ask to make sure you hire the right bookkeeper for your business. “So then why wouldn’t I hire an accountant who could handle all of the above? If you’re a small-to-medium business, the thought of hiring a bookkeeper seems lofty at best, and decadently impossible at worst. Her work has been featured on US News and World Report, Business.com and Fit Small Business.

$200 – $1,000+ average cost per month (part-time)

Not every business owner needs the same level of financial management services. Depending on your industry, the size of your company, how many employees you have, and how long you’ve been operating, you may need more or less support. Managing your own business is no simple task— between juggling inventories, supervising employees, and growing your clientele, business owners have a lot to handle. Having a bookkeeper or accounting team on-hand is one of the most important investments you can make to grow your business.

- We support thousands of small businesses with their financial needs to help set them up for success.

- When bookkeeping tasks become too time-consuming to handle on your own, hiring an online bookkeeping service can be a worthwhile investment.

- If you’re growing, the outsourced bookkeeping service should be able to help you scale by adding full service accounting when you are ready for it.

- When you need to reference a customer in a transaction, they appear in a list.

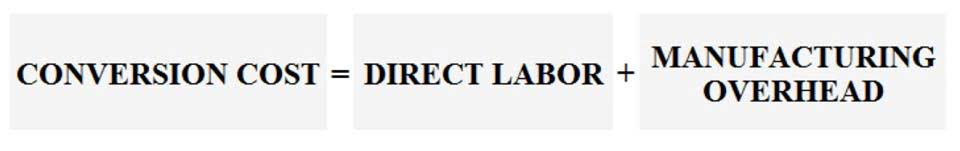

- Accountants interpret, classify, analyze, report, and summarize financial data.

- He also states the importance of protecting your financial information by backing up your data.

How Much Do Bookkeeping Services for Small Businesses Cost?

Small business accounting software can generate them, but you may need an accounting professional to analyze them and tell you in concrete terms what they mean for your company. Would you like to let customers pay with credit cards and bank withdrawals? Then, you need to sign up with a payment processor such as PayPal or Stripe. For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions. Eight small business accounting applications scored high enough to be included in our list of the best small business accounting software.

Bookkeeping cost factors

The least amount you can expect to pay in bookkeeping fees is $348 a month. Larger businesses would need a full time bookkeeper which costs between $55,000 to $85,000 a year. Outsourcing accounting services allows you to reap the benefits of an accountant without the costs of a full-time employee, such as insurance and other benefits. Bookkeeper salaries vary state by state (see our chart below), and depending on where you live, you could be paying a large difference in one place versus another. It might make sense for a large business with complex bookkeeping needs year-round to have an in-house bookkeeper.

- On the advising side, your accountant uses your financial statements to help you maximize your earnings throughout the year.

- Sales, production, and employee retention are all extremely important.

- These professionals do a lot of different things, but not every bookkeeper does every service, or they may charge extra for specific tasks.

- It’s important to ask if they guarantee a certain level of quality, so the accuracy doesn’t change from person to person.

- Some popular virtual bookkeeping services are Bench, QuickBooks Live and Bookkeeper360.

- The more experienced the bookkeeper, the more confident they are with their skills.

- His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

With all your software linked through the cloud, payments that you make and receive can be automatically recorded to a digital ledger. The software program can then make the calculations for you, giving you an accurate picture of your total income and spending that’s updated every time your money moves. Double-entry accounting enters every transaction twice as both a debit and a credit. Your business’s books are balanced when all of the debits equal (or cancel out) all of the credits. And since it takes equity, assets and liabilities — on top of expenses and income — into account, it typically gives you a more accurate financial snapshot of your business. Single-entry accounting records all of your transactions once, either as an expense or as income.

In-house accounting, on the other hand, gives you peace of mind knowing that someone you know and trust is handling your books and financials. The only drawback of paying a full-time accountant is that you may need to offer them employee benefits. As great as it is to talk about potential bookkeeping costs and get estimates, we know that seeing an actual average for your state can yield excellent value for you as a business owner. Please see the chart below with data pulled directly from the US Bureau of Labor Statistics 2022 data to learn more about the average salary and hourly rate for bookkeeping.

A freelancer may or may not have experience working directly with CPAs. Ask about this during the consultation process, to determine their capacity for helping an accountant file your taxes on time. In both cases, if you use dedicated bookkeeping software, you should ensure that your bookkeeper uses the same brand. They may be able to import expenses remotely, cutting out email threads or trips to the office. A freelance bookkeeper is the most affordable option if your finances are simple, and you’re okay with your bookkeeper not being available for you every single business day.

We work hard to evaluate the necessary tools and technologies that support remote work relationships while providing the key checks and balances needed in bookkeeping. With the idea of hiring a full-time accountant on your roster now put to bed, let’s consider what kind of bookkeeping you may need. But when it comes to bookkeeping, hiring an employee to handle it may not be realistic – at least not yet.

Full-service bookkeeping is everything you’d find in basic bookkeeping with additional accounting services and financial statement analysis. You want the product to allow room for your business to grow, but you don’t want to spend a lot of extra money on features you may never need. Most of the accounting services we reviewed are available in multiple versions, so you can start at the low end and upgrade to a more powerful edition that looks and how much does bookkeeping cost works similarly. If you’re traveling and have expenses on the road, you can usually take pictures of receipts with your smartphone and upload them to your accounting app. Others, such as Intuit QuickBooks Online and Xero, read the receipts and transfer some of their data (such as date, vendor, and amount) to an expense form using optical character recognition technology. Once you have completed an invoice, for example, you have several options.

What’s your online bookkeeping services budget?

Bookkeeping accounting lets you know if your small business needs extra employees or requires operational changes. Accounting software eliminates a good deal of manual data entry, https://www.bookstime.com/articles/deposit-slip making it entirely possible to do your own bookkeeping. However, it can be difficult to catch up if you fall behind on reconciling transactions or tracking unpaid invoices.