Government education loan Forgiveness had previously been a once-in-a-life chance. There are, not, several choice offered nowadays, particularly MOHELA education loan forgiveness .

Which money forgiveness is among the loan providers that help individuals to the choosing which fees choice is right for Roosevelt got aside a quick payday loan their demands and you can money, as well as Teacher Home loan Forgiveness apps , Income-Computed Charge Arrangements (IDR), and you will Public service Financing Forgiveness (PSLF).

If you have MOHELA college loans, you can consider refinancing to arrive less notice. As a result, you may be able to lower your monthly premiums and you can pay about your debt more quickly.

If you have MOHELA student education loans, you must understand the way the team functions and you will shell out of the debt. That’s what this informative guide issues.

While the a personal monetary, MOHELA did that have figuratively speaking for a long period. Just like the a nationwide financial servicer, it’s stayed a new member. But not, the latest You.S. Training Business produced in that MOHELA would take over FedLoan Servicing’s PSLF and you may Teach Give application .

MOHELA has been moving certain FedLoan account. Other PSLF subscription and Train Promote readers always be ran a bit when you look at the 2022.

MOHELA may also accept of numerous debtors with the earnings-motivated prices plans . Thus, it may be guilty of more financing that apt to be qualified to receive financial support forgiveness subsequently.

MOHELA currently just holds a small % out of IDR arrangements. Unfortuitously, this bit is really reasonable after the newest Services out-of Training levels knowledge, it lump it investment servicer towards with other nonprofit servicers.

An expression For the MOHELA Education loan Forgiveness

At the time of the following quarter off 2021, the latest REPAYE program had more than $194.9 billion into the an excellent money for over 3.twenty-7 mil individuals. Nonprofit servicers typically (not just MOHELA) provider just pretty much $10.half dozen mil for the an effective REPAYE financing. Which looks like so you’re able to almost three hundred,100 debtors.

Thus, it would be fascinating to see exactly how MOHELA covers they greatest changeover, and you may exactly what display out-of pricing agreements they undertake when confronted with such as for example high home loan servicer alter.

What is MOHELA?

MOHELA is largely a student-based loan fix people based in St. Louis, Missouri, with workplaces to the Columbia, Missouri, and you can Washington, DC. MOHELA provides much more three decades of experience off sector.

MOHELA works together some one and you may alumni who’ve knowledgeable particular financial demands and provides particular solutions to generate charges easier, helping them inside their go a loans-free condition.

If you have MOHELA college loans, you must know how the firm works and you can spend the money for loans. MOHELA will be the merely servicer to own people subscribed to the newest Show Promote System and you may PSLF with the 2022.

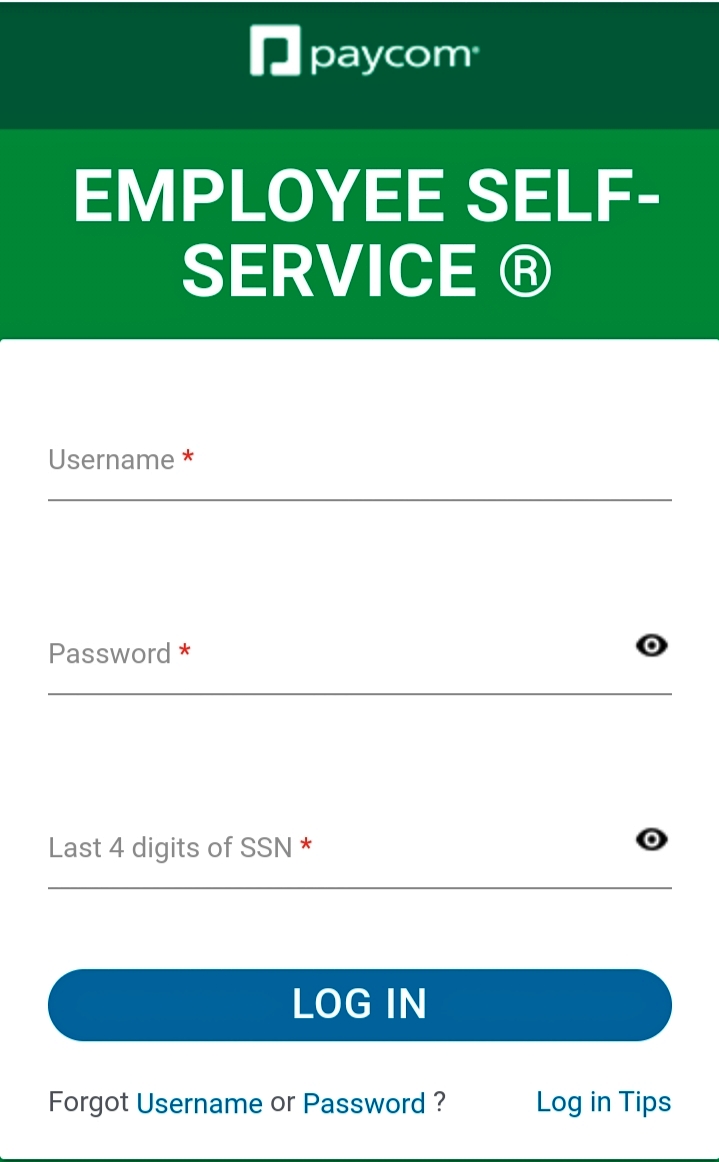

To get to on the internet entry to your finances, you ought to register. You could contact MOHELA, read the month-to-month charging you statements, and you will pay statements once you’ve access.

Sign-up automatic costs. MOHELA can subtract your bank account out of your family savings immediately. Additionally, you will put away 0.twenty-five fee products on your appeal by applying for autopay.

Join an enthusiastic IDR plan centered on your income. By the entry a newspaper form having MOHELA, you could request income-inspired payment, and this minimises your student loan repayments so you’re able to a portion of the income.

Asks for forbearance and you may deferment is actually canned. For individuals who qualify, MOHELA can assist you inside briefly finishing using repayments otherwise cutting your month-to-month amount. This helps you end standard by continuing to keep your for the a standing. not, attention can continue steadily to accrue while in the episodes off deferment or forbearance.

Processes you to-sometime monthly installments. MOHELA will keep track of your instalments and you may gather simplycashadvance.net personal loans for credit score under 550 her or him. If you’d like to build way more payments, you can tell MOHELA to make use of these to your existing harmony (on the web, because of the mobile, otherwise of the post). Or even, the other money tends to be applied to the following month’s payment.