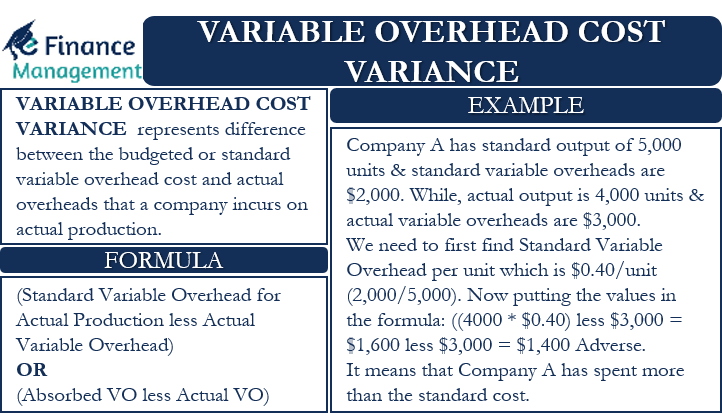

This system, which treats fixed manufacturing costs as a product cost, is required for external financial statements. If the outcome is favorable (a negative outcome occurs in the calculation), this means the company was more efficient the fixed overhead spending variance is calculated as: than what it had anticipated for variable overhead. If the outcome is unfavorable (a positive outcome occurs in the calculation), this means the company was less efficient than what it had anticipated for variable overhead.

Analysis:

In this rare scenario, we can assume that production department cannot be held responsible for fixed overhead variances. However, as the name suggested, it is the fixed overhead volume variance that is more about the production volume. Likewise, we can also determine whether the fixed overhead volume variance is favorable or unfavorable by simply comparing the actual production volume to the budgeted production volume. Fixed Overhead Spending Variance is calculated to illustrate the deviation in fixed production costs during a period from the budget. The variance is calculated the same way in case of both marginal and absorption costing systems. Specifically, fixed overhead variance is defined as the difference between standard cost and fixed overhead allowed for the actual output achieved and the actual fixed overhead cost incurred.

Fixed Overhead Budget Variance

During production, any relevant fixed overhead expenditure changes can be indirect labor, additional insurance charges, additional safety contracts, additional rental or land leases, etc. Budget or spending variance is the difference between the budget and the actual cost for the actual hours of operation. This variance can be compared to the price and quantity variance developed for direct materials and direct labor. This is a simple variance to calculate as it is purely the difference between what a company budgeted to spend on their fixed overheads in total vs. The actual amount spent on fixed overheads.

- If Connie’s Candy only produced at \(90\%\) capacity, for example, they should expect total overhead to be \(\$9,600\) and a standard overhead rate of \(\$5.33\) (rounded).

- This is due to the actual production volume that it has produced in August is 50 units lower than the budgeted one.

- Therefore, these variances reflect the difference between the Standard Cost of overheads allowed for the actual output achieved and the actual overhead cost incurred.

- We indicated above that the fixed manufacturing overhead costs are the rents of $700 per month, or $8,400 for the year 2023.

- The method of allocation is more fully discussed in our applied overhead tutorial.

Analysis

Either way, it is simply the difference in spending from budgeted and actual fixed overhead costs. As an example of an unfavorable fixed overhead spending variance, a passing tornado delivers a glancing blow to the production facility of Hodgson Industrial Design, resulting in several hundred roofing tiles being blown off. This cost is part of the facilities maintenance budget, which normally does not vary much from month to month, and so is part of the company’s fixed overhead. Companies typically establish a standard fixed manufacturing overhead rate prior to the start of the year and then use that rate for the entire year.

Accountants realize that this is simplistic; they know that overhead costs are caused by many different factors. Nonetheless, we will assign the fixed manufacturing overhead costs to the aprons by using the direct labor hours. This variance would be posted as a credit to the fixed overhead budget variance account. In a standard costing accounting system, the fixed overhead variance is the difference between the standard fixed overhead and the actual fixed overhead. The amount of expense related to fixed overhead should (as the name implies) be relatively fixed, and so the fixed overhead spending variance should not theoretically vary much from the budget.

Fixed Overhead Volume Variance

Standard fixed overhead rate can be calculated with the formula of budgeted fixed overhead cost dividing by the budgeted production volume. It is important to start by noting that fixed overhead in themaster budget is the same as fixed overhead in the flexible budgetbecause, by definition, fixed costs do not change with changes inunits produced. Thus budgeted fixed overhead costs of $140,280shown in Figure 10.12 will remain the same even though Jerry’sactually produced 210,000 units instead of the master budgetexpectation of 200,400 units. Interpretation of the variable overhead rate variance is often difficult because the cost of one overhead item, such as indirect labor, could go up, but another overhead cost, such as indirect materials, could go down. Often, explanation of this variance will need clarification from the production supervisor.

A favorable variance occurs when the costs incurred are lower than the budgeted costs. In the standard costing system, the fixed overhead is posted at the standard cost of 11,960, represented by the debit to the work in process inventory account. This type of variance is calculated separately for direct variable expenses and overhead variable expenses. This is the portion of volume variance that is due to the difference between the budgeted output efficiency and the actual efficiency achieved.

Fixed manufacturing overhead costs remain the same in total even though the production volume increased by a modest amount. For example, the property tax on a large manufacturing facility might be $50,000 per year and it arrives as one tax bill in December. The amount of the property tax bill did not depend on the number of units produced or the number of machine hours that the plant operated. Although the fixed manufacturing overhead costs present themselves as large monthly or annual expenses, they are part of each product’s cost. The fixed factory overhead variance represents the difference between the actual fixed overhead and the applied fixed overhead.

The fixed manufacturing overhead volume variance is the difference between the amount of fixed manufacturing overhead budgeted to the amount that was applied to (or absorbed by) the good output. If the amount applied is less than the amount budgeted, there is an unfavorable volume variance. This means there was not enough good output to absorb the budgeted amount of fixed manufacturing overhead. If the amount applied to the good output is greater than the budgeted amount of fixed manufacturing overhead, the fixed manufacturing overhead volume variance is favorable. Connie’s Candy used fewer direct labor hours and less variable overhead to produce \(1,000\) candy boxes (units). As in the marginal costing method, overheads are written off to the income statement, so the only variance occurring will be the overheads expenditure variance.